- by New Deal democrat

The snooze-a-thon in jobless claims continues, as both initial and continuing claims are well-behaved within the narrow range where they have been generally for the past six months.

Initial claims were unchanged least week at 208,000, while the four week moving average declilned -3,500 to 210,00. With the usual one week delay, continuing claims were unchanged at 1.774 million, which is tied for the lowest level in nearly 9 months except for a three week period right at the turn of the year:

Ask per usual, the YoY% change is more important for forecasting purposes. On that basis initial claims were down -2.8%, the four week average down -3.1%, and continuing claims higher by 4.0%, just above last week’s 14 month low point for that metric:

As has been the case for a number of months, since jobless claims lead the unemployment rate with a several month lag, plugging these numbers into the Sahm rule indicates that we should expect the unemployment rate not to rise from 3.8% in tomorrow’s report, and it is more likely to decline to 3.7% or even 3.6% in the next few months:

The forecast is for continued economic expansion.

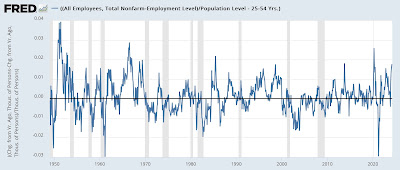

Turning to several more metrics that guide my thinking on tomorrow’s employment report, here’s a look at the status of the “consumption leads employment” indicator. The YoY% change in both real retail sales and real personal consumption have improved in recent months, but nevertheless I would expect a slow deceleration in the YoY comparisons of monthly job growth to continue:

Since last spring we were running close to 300,000 monthly, I would expect less than that but probably greater than 200,000 tomorrow. Lots of monthly noise! But that should be the trend.

Here is a repeat of yesterday’s graph of the quits rate vs. YoY wage gains:

I expect the trend of deceleration to continue with wage gains as well. I am looking for a range of between 4.1% to 4.4% YoY.

Continuing as to wages, the below historical graph of the YoY% change in wages is what is behind my not being alarmed about the recent monthly upticks in inflation:

Note that with the exception of twice in the 1970s stagflation era, YoY wage growth has always increased as the expansion wears on. If I saw wage growth turn around and start to rise again, I would be alarmed. But that simply isn’t happening.

Finally, earlier this week the Employment Cost Index for Q1 was reported, showing an uptick to 1.1% q/q for wages and 1.2% q/q for all compensation including other benefits:

These series are both a little noisy, and I interpret the quarterly wage increase as being within the normal range of fluctuation. Benefits compensation, on the other hand, definitely jumped. This index is important because, as the BLS’s explanation indicates:

“The Employment Cost Index measures the change in the hourly labor cost to employers over time. The ECI uses a fixed ‘basket’ of labor to produce a pure cost change, free from the effects of workers moving between occupations and industries and includes both the cost of wages and salaries and the cost of benefits.”

In other words, the ECI is not affected by the change in the make-up of the job market (such as we had during the pandemic, when many more low wage workers were laid off in comparison with high-wage workers).

The E.C.I. Is telling us that workers still have a very strong “hand” compared with the past 50 years, if not quite as strong as several years ago.

This is the template of what I will be particularly looking for in tomorrow’s jobs report.